myCSUSM

myCSUSMTraining - Financial Transfer Requests

Campus Final Transfer Request Video

Auxiliary Accounting Transfer Request Video

- What should be contained in the journal and line description fields?

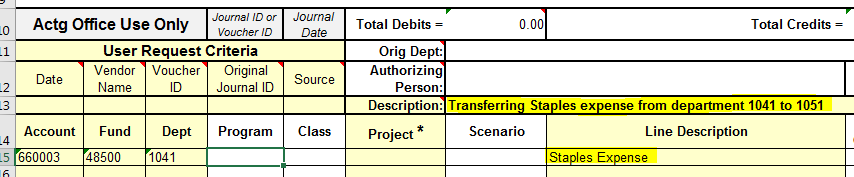

The journal description field found on row 13 should include the description that would describe the entire journal entry. This field is limited to 250 characters.

The line description field found on column H should include a concise description that is related to that specific transaction. For example, “Staples Expense” or “TRX to 81000” are acceptable descriptions. This field is limited to 30 characters. Any description over 30 characters will be truncated.

- What are acceptable forms of backup documentation?The most common form of backup documentation is a Data Warehouse report. In some cases other forms of backup documentation are acceptable upon approval from Fiscal Services.

- Who can I contact if I have more questions?

Please email accounting@csusm.edu or auxaccounting@csusm.edu if you have any questions. In order to ensure your email is directed appropriately, begin the subject line with the corresponding request code.

- FTR – Financial Transfer Request

- BUR – Billing Upload Request

- CB – Chargeback (both campus and inter-unit chargebacks)

- SA – Salary Adjustment

- When should I use fund 48501?

Fund 48501 is used when billing certain third-party service providers, salary expenses of CSUSM employees that are billed to auxiliary projects directly through payroll, and moving an expense from fund 48500 to an auxiliary project. Using fund 48501 to transfer funds from an auxiliary project will result in an invoice that will be generated at the end of the corresponding fiscal period. This invoice must be approved and sent to the appropriate Auxiliary accounts payable for payment to the campus. The majority of these transfers are now performed using an intra-unit transfer.

- What happens to my project number when using fund 48501?When using fund 48501 the auxiliary project number (column F) is shifted to the program field (column D). This will trigger CFS to automatically generate an invoice at the end of the corresponding fiscal period.

- When do I need to submit a billing request?

Aside from billing third-party vendors a BUR can be used to transfer funds between business units. Below are two scenarios in which a billing upload request is acceptable:

- When transferring auxiliary funds to a 496 campus fund.

- When transferring funds from the campus business unit to an auxiliary business unit.

- When do I use intra-unit revenue and expense?

Intra-unit revenue (580858) and expenses (660919) are used when the revenue and expenses are between campus departments. The intra-unit revenue and expense account codes are to be used with, but not limited to, the following transactions:

- Student ID card charges

- Library ID card charges

- Extended Learning classes taken by CSU Employees

- Catalog charges

- Large format plotter charges

- What file format is acceptable for my request?Only Excel files will be accepted. Any request submitted in a format other than an excel file, without prior approval, will be rejected.

- When should I send my request to auxaccounting@csusm.edu vs accounting@csusm.edu?

In most cases, the business unit that will be receiving funds (or increasing revenue/decreasing expense) will predicate which resource mailbox your request should be remitted to.

- Example: A campus chartfield string currently has an expense that is to be paid by an auxiliary chartfield string. To transfer this expense to the auxiliary chartfield string, the request would be submitted to the Campus Accounting Resource Mailbox (accounting@csusm.edu). See also, “When should I use fund 48501?”

- Which user should be provided in the “Authorizing Person” cell found on the FTR form?A user with Fiscal Authority to approve the requested transfer must be included on the form. This should be the user who has authorized the transfer.

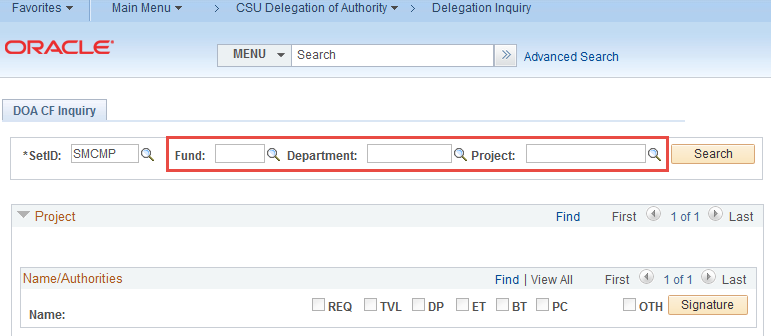

- How can I obtain Fiscal Authority information?

Fiscal Authority information can be obtained via the CFS menu item ‘CSU Delegation of Authority’. From this menu, you can select the submenu ‘Delegation Inquiry’ to inquire about fiscal authority as it relates to a corresponding Fund, Department, or Project.

- How do I know which chartfield string to debit(+) and which to credit(-)?When transferring expenses, positive values increase/debit the expense and negative values credit/decrease the expense. The opposite is true when dealing with revenue account codes. Positive values decrease/debit the revenue while negative values increase/credit the revenue.

- What should be included in my submission? (email, request, backup)All submissions should include a completed FTR form (or the form related to the request), appropriate backup documentation, approval from a user with fiscal authority, and the request code (FTR, BUR, CB, SA, etc.) at the beginning of the subject line of the email.

- Is a PDF transfer request permissible?PDF files will not be accepted.

- How long after submission can I expect to see my request in Data warehouse?Please allow up to seven business days for transfer requests to be reflected in data warehouse summaries and actuals reports.

- When should I provide an After the Fact Form?Requests submitted after a predetermined date before the fiscal year is closed regarding a prior fiscal period must be submitted with an After the Fact form. This is to ensure that any necessary reclassifications are submitted in an appropriate time frame throughout the course of the fiscal year.